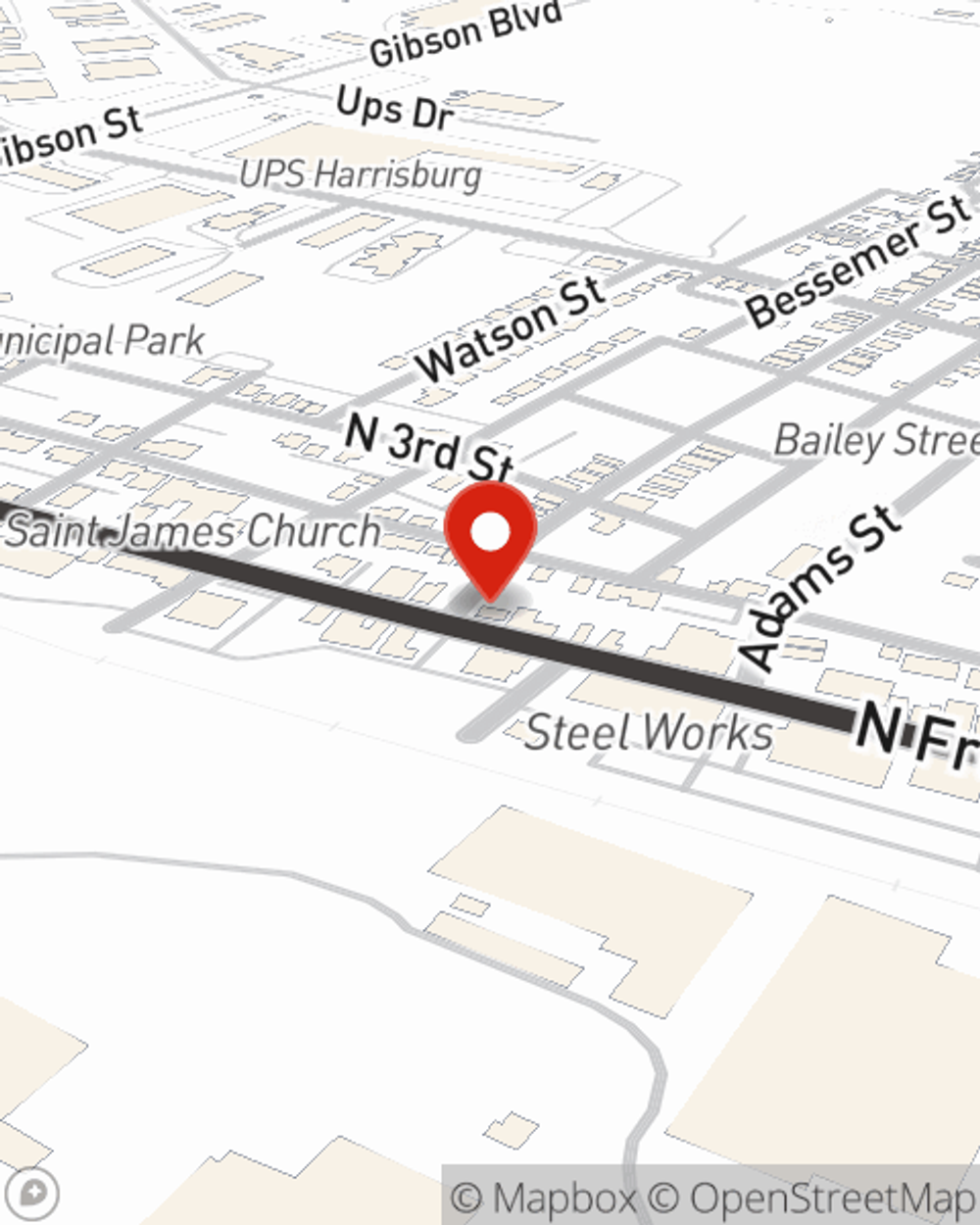

Business Insurance in and around Steelton

One of the top small business insurance companies in Steelton, and beyond.

This small business insurance is not risky

Coverage With State Farm Can Help Your Small Business.

Running a small business comes with a unique set of highs and lows. You shouldn't have to deal with those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, business continuity plans and worker's compensation for your employees, among others.

One of the top small business insurance companies in Steelton, and beyond.

This small business insurance is not risky

Customizable Coverage For Your Business

At State Farm, apply for the great coverage you may need for your business, whether it's a toy store, a music school or a lawn care service business. Agent John Sparks is also a business owner and understands what you need. Not only that, but personalized insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

Get right down to business by contacting agent John Sparks's team to discuss your options.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

John Sparks

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.